25+ How Do I Find My 2015 Tax Return On Turbotax information

How do i find my 2015 tax return on turbotax. Offer may change or end at any time without notice. With HR Block you can file an amended tax return online. Eligible for the Earned Income Tax Credit EITC. The software will find the right forms find the right tax credits and deductions and even do the math for you. Free Canadian income tax calculator quickly estimates your income tax refund or taxes owed federal and provincial tax brackets plus your marginal and average tax rates. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. Free Tax Software from TurboTax Canada. I told her i dont do my state taxes at the same time i do my. TurboTax Freedom Edition is available to taxpayers with income of 31000 or less or. The IRS is out of control. No cash value and void if transferred or where prohibited. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022.

However if you need to report additional income W2s Unemployment etc change your filing status claim missed tax credits and tax deductions then you do need to amend your tax return if it hasnt already been accepted by the IRS. Terms and conditions may vary and are subject to change without notice. From the creators of Canadas 1 tax software TurboTax Free is the newest addition to the TurboTax family of products. When do I need to file an amended tax return. How do i find my 2015 tax return on turbotax Form K-40 is a Form used for the Tax Return and Tax Amendment. Individual Income Tax Return entering the changes and explaining why you. Free File offers easy-to-use products that ask questions and you supply the answers. The lady said i should have put it down on my paperwork. Attention for Tax Year 2020. You NEED professional help. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Offer valid for returns filed 512020 - 5312020. A simple tax return Form 1040 only OR Form 1040 Unemployment income.

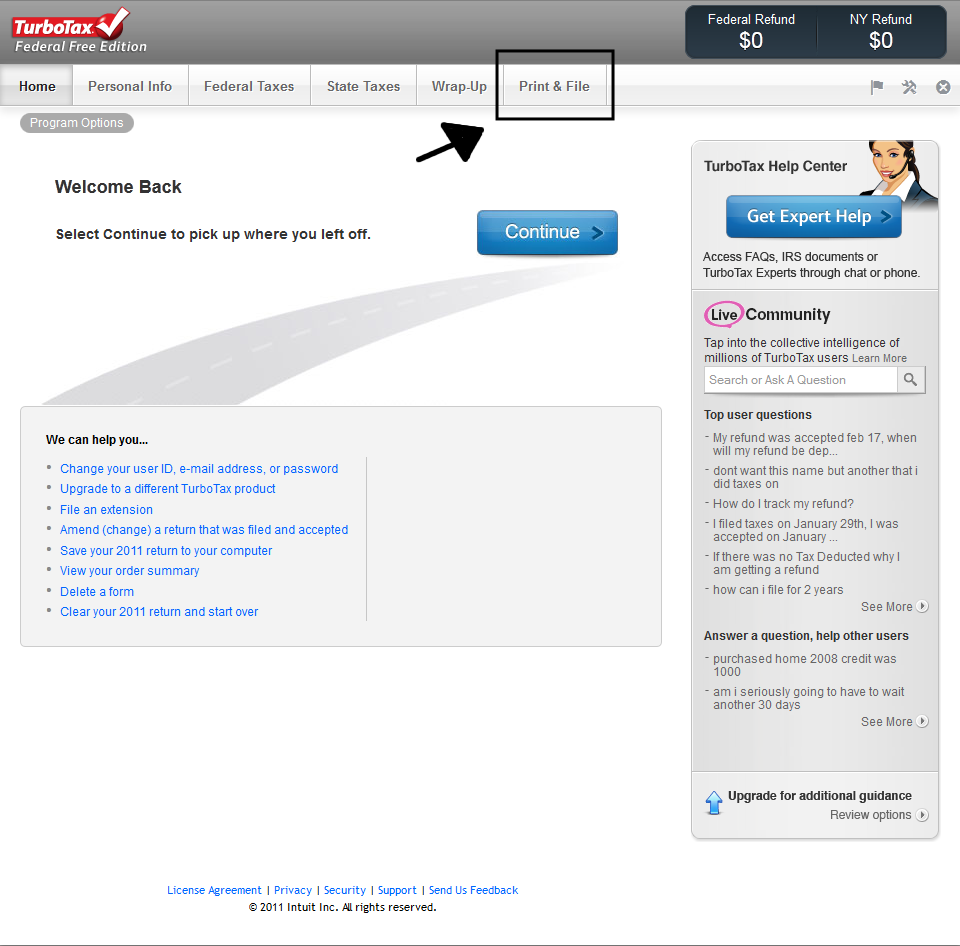

Blog Turbotax Online How To Print Your Tax Return

Blog Turbotax Online How To Print Your Tax Return

How do i find my 2015 tax return on turbotax I received this letter on the 4th of Apr 2015 and if I dont pay the taxes on it by the 29th of Apr 2015 I would have to pay the interest plus a penalty.

How do i find my 2015 tax return on turbotax. TurboTax Online is only available for current year tax returns. 1 TurboTax Free Guarantee 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. The IRS also began accepting electronically filed 1040-X forms in summer 2020.

To file your 2015 taxes you would need the TurboTax CDDownload software. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. Offer period March 1 25 2018 at.

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. For those of you who placed your rental property in service in tax year 2015 or before you can NOT amend tax year 2015 or before. States are handing unemployment in their own ways either conforming or decouplingThe state of Oregon has confirmed that taxpayers do not need to do anything in order to.

You can choose the software that best supports you tax needs by visiting the link Past Years Taxes and prepare your tax return. Electronic filing will allow faster receipt and fewer errors on amended returns the IRS says. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

May not be combined with other offers. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. 2 TurboTax pricing is based on your tax situation and varies by product.

This free tax software is ideal for simple returns and allows you to prepare and file your return quickly. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Terms and conditions may vary and are subject to change without notice.

These companies offer full-service packages that let you share your documents with a tax. If you claimed unemployment benefits in 2020 know that the American Rescue Plan signed into law on March 11 2021 made the first 10200 of unemployment compensation tax exempt. You MUST file the IRS Form 3115 - Change in Accounting Method with at least a 2016 amended return or newer.

If you filed your 2020 return with our online program you can prepare an amended return. Once youve been notified by the IRS that they have received and accepted your original return for 2020 then you can amend your tax return online. You can also find a tax professional through an online tax preparer such as HR Block or TurboTax.

If your e-filed tax return is rejected you can make changes before sending it in again If you want to make changes after the original tax return has been filed you must file an amended tax return using a special form called the 1040X Amended US. For now amendments to forms 1040 and 1040-SR can be filed electronically only for the 2019 tax year.

How do i find my 2015 tax return on turbotax For now amendments to forms 1040 and 1040-SR can be filed electronically only for the 2019 tax year.

How do i find my 2015 tax return on turbotax. If your e-filed tax return is rejected you can make changes before sending it in again If you want to make changes after the original tax return has been filed you must file an amended tax return using a special form called the 1040X Amended US. You can also find a tax professional through an online tax preparer such as HR Block or TurboTax. Once youve been notified by the IRS that they have received and accepted your original return for 2020 then you can amend your tax return online. If you filed your 2020 return with our online program you can prepare an amended return. You MUST file the IRS Form 3115 - Change in Accounting Method with at least a 2016 amended return or newer. If you claimed unemployment benefits in 2020 know that the American Rescue Plan signed into law on March 11 2021 made the first 10200 of unemployment compensation tax exempt. These companies offer full-service packages that let you share your documents with a tax. Terms and conditions may vary and are subject to change without notice. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. This free tax software is ideal for simple returns and allows you to prepare and file your return quickly. 2 TurboTax pricing is based on your tax situation and varies by product.

For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. May not be combined with other offers. How do i find my 2015 tax return on turbotax Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Electronic filing will allow faster receipt and fewer errors on amended returns the IRS says. You can choose the software that best supports you tax needs by visiting the link Past Years Taxes and prepare your tax return. States are handing unemployment in their own ways either conforming or decouplingThe state of Oregon has confirmed that taxpayers do not need to do anything in order to. For those of you who placed your rental property in service in tax year 2015 or before you can NOT amend tax year 2015 or before. If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Offer period March 1 25 2018 at. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. To file your 2015 taxes you would need the TurboTax CDDownload software.

4 Steps From E File To Your Tax Refund The Turbotax Blog

The IRS also began accepting electronically filed 1040-X forms in summer 2020. 1 TurboTax Free Guarantee 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. TurboTax Online is only available for current year tax returns. How do i find my 2015 tax return on turbotax.