46+ Business Structures Forming A Corporation Llc Partnership Or Sole Proprietorship Ideas

Business structures forming a corporation llc partnership or sole proprietorship. There are three common types of businesses. To form an LLC one. C corporations are taxed twice. You and you alone fund the business and make the business decisions. The shareholders do not necessarily operate the business. Sole Proprietorship Vs. A Corporation or an LLC. The various entity types possible including corporations LLCs and partners. There are exceptions fraud or the failure to pay taxes for example. There are three main categories of businesses in Canada. You can operate a sole proprietorship under your own name or under another name youve chosen as long as you dont add any of the legal designations of. FREE shipping on qualifying offers.

For that reason most serious startup owners dont choose a sole proprietorship for their legal entity. Unlike a sole proprietorship or partnership forming a corporation requires filing articles of incorporation with the state where the corporation will conduct business. A corporation is a legal entity that is separate from its owners called shareholders. The LLC is a unique hybrid. Business structures forming a corporation llc partnership or sole proprietorship A corporation or incorporated company is owned by shareholders each of whom is a separate legal entity from the company. The business pays taxes at the corporate level and shareholders pay taxes on income received. As the name suggests a sole proprietorship is a company of one. We suggest you contact a lawyer or accountant if you are not sure which type of business structure. However they are generally less onerous than other corporations to start and operate. Heres an overview of these three structures. Forming a Corporation LLC Partnership or Sole Proprietorship Entrepreneur by Michael Spadaccini Paperback 3484 Only 1 left in stock - order soon. Informal business structures like sole proprietorships and partnerships dont offer protection because there isnt any separation between the. LLCs have become very popular because they provide the flexibility informality and tax attributes of a partnership or sole proprietorship and the limited liability of a corporation.

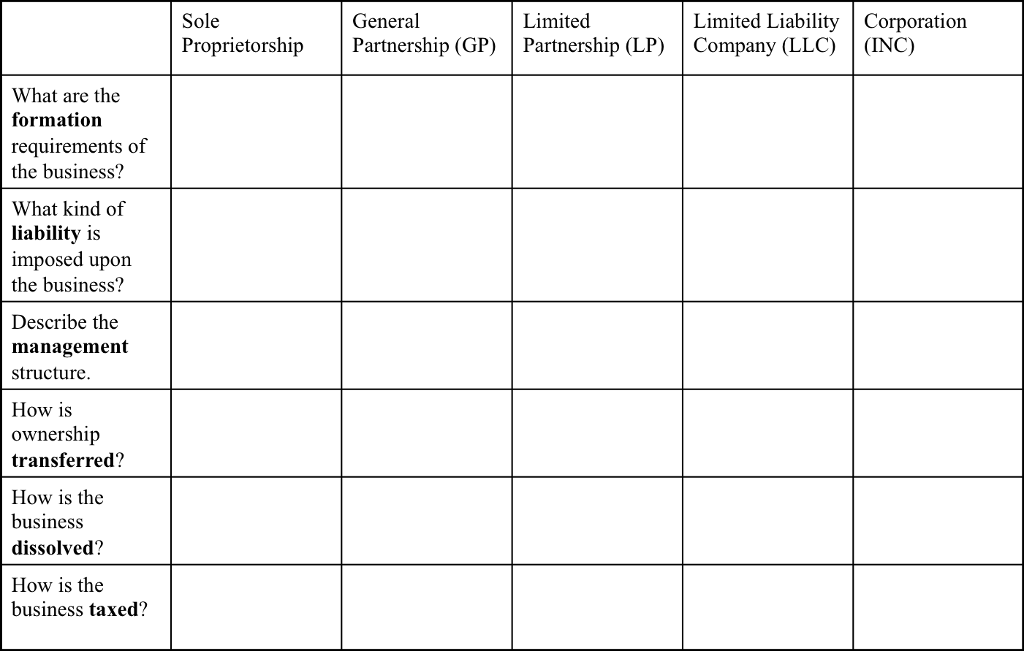

Comparison Of Business Entities Startingyourbusiness Com

Comparison Of Business Entities Startingyourbusiness Com

Business structures forming a corporation llc partnership or sole proprietorship The limited liability company or LLC is the newest type of business form in the United States.

Business structures forming a corporation llc partnership or sole proprietorship. Forming a Corporation LLC Partnership Or Sole Proprietorship Entrepreneur magazines legal guide. But generally your liability is limited by these legal structures. They are more complex than sole proprietorships and partnerships.

Sole Proprietorship Partnership and Corporation. A corporation or incorporated company sole proprietorship and partnership. Each of these structures has their own benefits and drawbacks making it very important for a businesses.

Forming a Corporation LLC Partnership or Sole Proprietorship Entrepreneur Magazines Legal Guide. In this video Dr. Cozette discusses the benefits of structuring your business.

The simplest form of business is the sole proprietorship a business owned and operated by one individual. Subchapter S corporations and limited liability companies are other kinds of corporations. What are the advantages for your business of incorporating a company versus registering a partnership or a sole proprietorship.

They both offer more limits on liabilities than sole proprietorships and partnerships. Compared to corporations and LLCs sole proprietorships and general partnerships are typically less costly to set up. Depending on the corporation.

A cross between a partnership or proprietorship and corporation. LLCs S corporations and sole proprietorships are taxed once on profits received. There is no legal distinction between the owner and the business in a sole proprietorship.

If you work as a freelancer you actually operate as a sole proprietor without having to file anything. Formal business structures like LLCs and corporations offer liability protection because the business is legally separated from its owner. For most small businesses not wanting to form a partnership the three common options are Sole Proprietorship Limited Liability Company LLC and Corporation.

Instead shareholders elect a board of directors who then elects the corporations officers to operate the business. With Corporations Partnerships and LLCs the answer is generally no. Sold by Spiegs Stuff and ships from Amazon Fulfillment.

Nonprofits with 501c3 status are exempt from federal income taxes. Each structure has different and important implications for liability taxation and succession. Sole proprietorships are the most common and easiest business structure to form.

Business structures forming a corporation llc partnership or sole proprietorship Sole proprietorships are the most common and easiest business structure to form.

Business structures forming a corporation llc partnership or sole proprietorship. Each structure has different and important implications for liability taxation and succession. Nonprofits with 501c3 status are exempt from federal income taxes. Sold by Spiegs Stuff and ships from Amazon Fulfillment. With Corporations Partnerships and LLCs the answer is generally no. Instead shareholders elect a board of directors who then elects the corporations officers to operate the business. For most small businesses not wanting to form a partnership the three common options are Sole Proprietorship Limited Liability Company LLC and Corporation. Formal business structures like LLCs and corporations offer liability protection because the business is legally separated from its owner. If you work as a freelancer you actually operate as a sole proprietor without having to file anything. There is no legal distinction between the owner and the business in a sole proprietorship. LLCs S corporations and sole proprietorships are taxed once on profits received. A cross between a partnership or proprietorship and corporation.

Depending on the corporation. Compared to corporations and LLCs sole proprietorships and general partnerships are typically less costly to set up. Business structures forming a corporation llc partnership or sole proprietorship They both offer more limits on liabilities than sole proprietorships and partnerships. What are the advantages for your business of incorporating a company versus registering a partnership or a sole proprietorship. Subchapter S corporations and limited liability companies are other kinds of corporations. The simplest form of business is the sole proprietorship a business owned and operated by one individual. Cozette discusses the benefits of structuring your business. In this video Dr. Forming a Corporation LLC Partnership or Sole Proprietorship Entrepreneur Magazines Legal Guide. Each of these structures has their own benefits and drawbacks making it very important for a businesses. A corporation or incorporated company sole proprietorship and partnership.

Solved Business Organization Comparison Chart Fill Out Th Chegg Com

Solved Business Organization Comparison Chart Fill Out Th Chegg Com

Sole Proprietorship Partnership and Corporation. They are more complex than sole proprietorships and partnerships. But generally your liability is limited by these legal structures. Forming a Corporation LLC Partnership Or Sole Proprietorship Entrepreneur magazines legal guide. Business structures forming a corporation llc partnership or sole proprietorship.

Business structures forming a corporation llc partnership or sole proprietorship